In today's competitive business landscape, securing financing can be a significant hurdle, especially for entrepreneurs with bad credit. A bad credit score can limit access to traditional loans, making it challenging to grow a business or navigate ROK Financial services (just click the next website) difficulties. However, understanding bad credit business loans can open doors to alternative funding options. This article explores what bad credit business loans are, the types available, their pros and cons, and strategies for improving your creditworthiness.

What are Bad Credit Business Loans?

Bad credit business loans are financial products specifically designed for entrepreneurs with poor credit scores. A bad credit score typically falls below 580 on the FICO scale. Lenders consider various factors, including your credit history, current debts, and overall financial health, when evaluating your loan application. These loans often come with higher interest rates and less favorable terms compared to loans offered to borrowers with good credit.

Types of Bad Credit Business Loans

- Alternative Lenders: Online lenders and fintech companies often provide loans to businesses with bad credit. These lenders may have more lenient eligibility criteria than traditional banks, allowing borrowers to access funds more quickly.

- Merchant Cash Advances (MCAs): MCAs provide a lump sum of cash in exchange for a percentage of future credit card sales. While they are quick to obtain, they can be costly due to high fees and interest rates.

- Invoice Financing: This option allows businesses to borrow against outstanding invoices. It can be a good choice for companies with slow-paying clients, as it provides immediate cash flow without requiring a credit check.

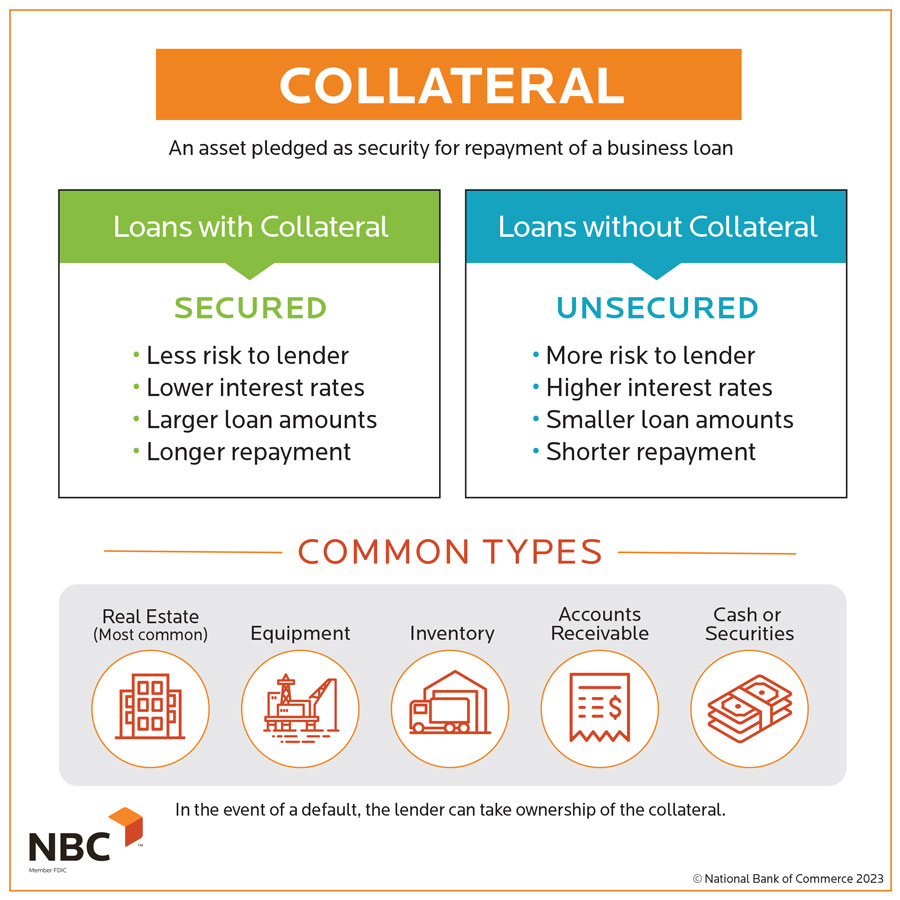

- Equipment Financing: If you need funds to purchase equipment, this type of loan uses the equipment itself as collateral. Even borrowers with bad credit can qualify, as the lender can repossess the equipment if payments are not made.

- Microloans: Nonprofit organizations and community lenders often provide microloans to small businesses. These loans typically have lower amounts and may come with more flexible terms.

Pros and Cons of Bad Credit Business Loans

Pros:

- Accessibility: Bad credit loans can provide access to capital when traditional financing options are unavailable.

- Quick Funding: Many alternative lenders offer fast approval and funding, allowing businesses to address urgent financial needs.

- Variety of Options: Entrepreneurs can choose from various loan types to find the best fit for their specific situation.

- Higher Interest Rates: Borrowers with bad credit often face significantly higher interest rates, increasing the overall cost of borrowing.

- Shorter Loan Terms: Many bad credit loans come with shorter repayment periods, which can strain cash flow.

- Risk of Debt Cycle: Businesses may find themselves in a cycle of debt if they rely on high-cost loans to cover operational expenses.

Strategies to Improve Your Chances of Approval

- Work on Your Credit Score: Take steps to improve your credit score before applying for a loan. Pay down existing debts, make timely payments, and correct any inaccuracies on your credit report.

- Provide Collateral: Offering collateral can increase your chances of approval. Lenders may be more willing to lend if they have a form of security in case of default.

- Prepare a Solid Business Plan: A well-prepared business plan demonstrates your commitment and outlines how you plan to use the funds. This can help convince lenders of your ability to repay the loan.

- Seek a Co-Signer: If possible, find a co-signer with good credit who can back your loan. This can improve your chances of approval and may lead to better loan terms.

- Consider Peer-to-Peer Lending: Platforms that connect borrowers with individual investors may provide more flexible terms and lower rates than traditional lenders.

Conclusion

Bad credit business loans can be a lifeline for entrepreneurs facing financial challenges. While they come with higher costs and risks, understanding the options available can empower business owners to make informed decisions. By taking steps to improve creditworthiness and exploring alternative funding sources, entrepreneurs can find the financial support they need to grow their businesses. Whether you're seeking a quick cash infusion or a long-term loan, knowing your options can make all the difference in navigating the world of business financing.